Introduction Managing rental properties can be rewarding, but it also comes......

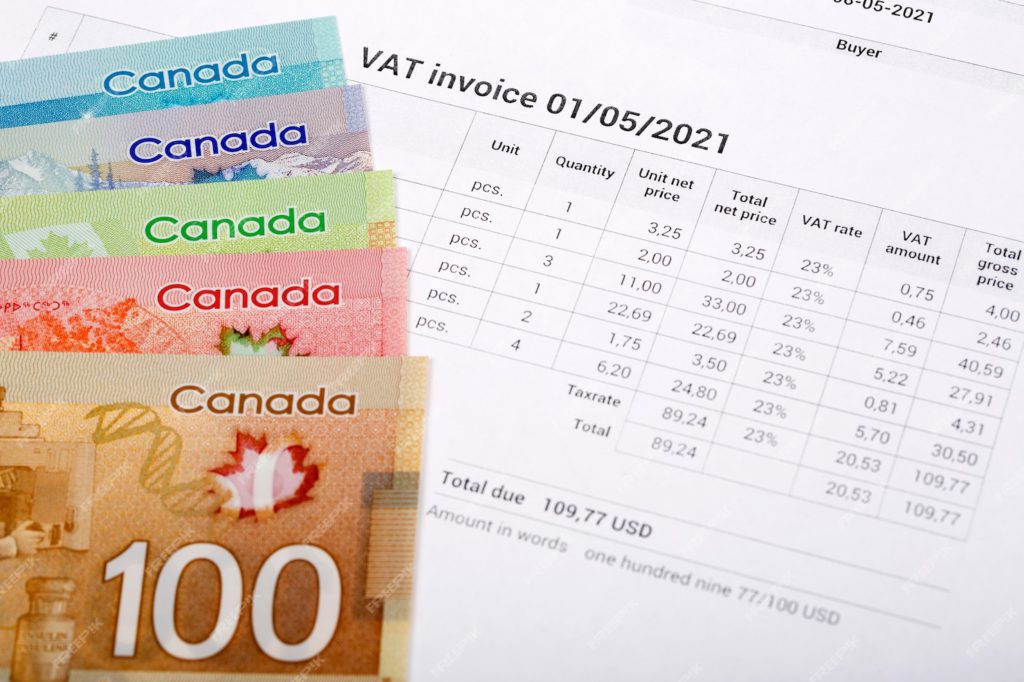

Tag Archives: CANADIAN ACCOUNTING & TAX BLOGS

Explore Canadian Accounting & Tax Blogs by Tax Partners Oshawa. Stay informed on tax tips, accounting insights, and CRA updates for individuals and businesses.

Introduction Understanding Canada’s tax system is essential for financial......

Introduction – What is a Tax Clearance Certificate? A Tax Clearance Certi......

Introduction: Reporting Foreign Pension Income in Canada Many individuals w......

Introduction: Understanding the Voluntary Disclosure Program The Voluntary ......

Introduction: Reporting Worldwide Income for Canadian Tax Purposes Canadian......

Unreported Offshore Assets: Understanding Your Obligations as a Canadian Re......

Introduction: Canadian Taxes and the Dark Web With the increasing availabil......

Introduction: Charity Tax Credits and the Risk of Tax Shelters Canada’s t......

Introduction: Tax Planning and Unintended Consequences Tax planning is cruc......